Lifetime Gifts and Inheritance tax

A gift is something that you give away during your lifetime that has value. A gift can be money, personal possessions, investments, land or property. It could also be paying for house repairs or services for a family member, for example.

You are free to make gifts of any amount to whoever you choose. Whether these gifts will be subject to inheritance tax upon your death will depend on the size of your estate, the availability of allowances and gifting history typically within the seven years before death.

A gift to an individual, or to a bare or ‘absolute’ trust, is known as a Potentially Exempt Transfer (PET). A gift to a trust is a Chargeable Lifetime Transfer (CLT). This article will focus on PETs. For further clarification, a bare / absolute trust, is one which has set beneficiaries which cannot be changed.

Inheritance Tax – The Basics

- Inheritance tax (IHT) is payable when a person dies and their estate exceeds the available allowances available at the time of death.

- Assets passing to a spouse, civil partner or registered charity are exempt from IHT.

- Your Nil-Rate Band (NRB) is £325,000 and is the tax-free amount available to your estate upon your death.

- The Residence Nil-Rate Band (RNRB) is £175,000. It is only available if you own a property and it passes on your death to qualifying beneficiaries such as children or grandchildren. There are further criteria that affect the availability of the RNRB, including estate size and property value.

- Married couples / civil partners can benefit from transferable NRB and RNRB allowances, which means a married couple with a home and children could potentially have combined allowances of £1 million before IHT is due.

- The NRB and RNRB allowances apply until 5th April 2030. The rate of IHT is 40%.

What is the 7-year rule?

Any gift that you give outside the available exemptions will first use up your NRB (£325,000).

- If your gift is less than this amount, there will be no inheritance tax to pay. What remains of your NRB will be available to your executors to apply to your estate on death.

- If you survive for 7 years after making a gift, your NRB will reset and be available to use again.

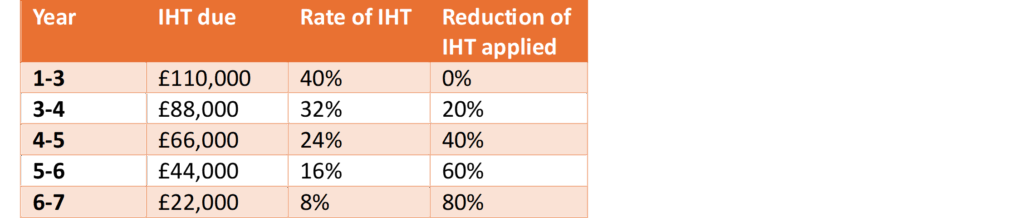

- For gifts above the Nil-Rate (£325,000), taper relief is available to reduce the amount of tax due if you die between 3 and 7 years after making the gift.

Examples

Example 1: Mark

Mark made gifts of £100,000 each to his son in April 2021 and his daughter in June 2022. He had already used his annual exemption of £3000 per year. If Mark died within seven years, there would be no IHT on the gifts due because the total gift amounts are below his Nil Rate Band of £325,000. If Mark survives 7 years from the date of his first gift, his available NRB will reset to £225,000 in April 2028, and by June 2029, his full NRB (£325,000) will be available again, assuming he hasn’t made any further non-exempt gifts.

Example 2: Sandra

Sandra makes a cash gift of £600,000 to her children. She has not made any non-exempt gifts previously. The £600,000 gift uses her NRB of £325,000 and means that £275,000 will be taxable if Sandra dies within seven years of her gift. Taper relief can be applied to reduce the tax due on the £275,000 excess if Sandra dies more than three years after the date of the gift. If Sandra survives for seven years, the gift will be exempt, and her NRB restored.

If inheritance tax becomes due, it would need to be paid by Sandra’s children, who are the beneficiaries of the gift. Sandra could explore the availability of a life insurance policy to cover the potential tax due. This could be paid for by Sandra’s children. It is also possible for Sandra to direct via her will that her estate pays the tax. Sandra would need to consider the impact of this carefully, particularly if the residuary beneficiaries are not her children.

Are there any tax-free gifts I can make?

There are a number of different gifts that you can make that are exempt from inheritance tax.

Annual Exemption – £3,000 per annum. If you haven’t used this allowance in the previous financial year you, can use the previous year’s exemption to gift £6,000. You cannot go back any further than this.

Small gift allowance – £250 to an unlimited amount of people. You cannot combine this gift with the annual allowance or wedding gift in the same year and give to the same person.

Wedding Gift

- £5,000 to a child

- £2,500 to a grandchild / great grandchild

- £1,000 any other person

Exempt People / Organisations – Gifts to your spouse, civil partner, registered charity or political parties are exempt from inheritance-tax.

You may maintain dependant relatives or your children whilst in full-time education such as university.

Gifts out of surplus income

There is no specific limit on the amount of income you can give. The criteria are that you can afford to make the payments regularly from your income (not capital), after the deduction of living expenses. Income could be used to pay school fees, pay rent for a child or give financial support to a relative. Records of the gifts and income sources must be kept.

Important points to note:

- Gifts with reservation – if you make a gift and continue to benefit from it, then the value of the gift will remain in your taxable estate. e.g. gifting a holiday home to your children and continuing to use it without paying the market rent.

- Capital gains tax may be due if you give away an asset that has increased in value since you owned it. e.g. property, land, art.

- Health – If care needs are foreseeable, then gifting money, property or valuable possessions at this point could be viewed as a ‘deliberate deprivation of assets’ by the local authority.

Practical tip: Keep a record of any gifts that you give and let your executors know where to find this. It will help them to complete the inheritance tax return more easily.

The information in this guide is for general information only. It is not tax or financial advice.