Five good reasons to make a Will

Making a Will is an important way of caring for the future of your loved ones. It shows that you have given thought to how your family would cope when you are no longer here and that you have taken action to protect them.

Without a Will, you have no say in where your money will go upon your death. The law sets out a strict order of who will be entitled. If there are no relations identified then your money will go to the Government.

Five good reasons to make a Will

1. Provide financial security for your loved ones

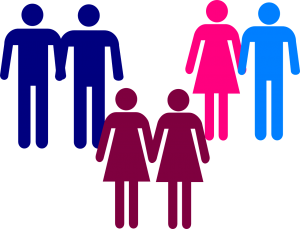

You may not be aware that the law makes no automatic provision for unmarried partners or step-children to inherit. If no Will is made, your loved ones will need to make their case at Court.

As you can imagine, this would be the last thing that they would need at a time of grief. In addition to the stress and expense of going to Court, there is no guarantee that they would receive the amounts you may want to give them.

If you are married, depending on the size of your estate, your spouse may not receive everything you own. It could result in assets being diverted away from your spouse at a time when he/she would actually need them.

2. Ensure children are looked after by people you trust and that money is available for their upkeep

A Will is a valid way to nominate people you trust to act as guardians of your children if you should sadly die before they reach eighteen. If you don’t make a Will, then the Local Authority and Courts will decide without knowing your wishes as a parent. Your children’s inheritance will be held on statutory trust until they reach their eighteenth birthday. This could mean your child inheriting a large lump sum at an age when they may not be able to manage this wisely.

In a Will, you can set up a trust to ensure that money is available for your children as they grow up but is also protected longer term beyond the age of eighteen.

This is a very popular choice amongst parents because it is a practical way of achieving peace of mind for your children’s financial security.

3. You can make gifts to charities or people you care about

Although you are under no obligation to do so, within a Will you can make specific gifts of money or personal possessions to go to charities, friends, family or whoever you wish. Some people like to leave fixed sums of money (e.g. £500 to my nephew) or a percentage of their estate as a gift to charity or others. You can also leave specific personal possessions to who you think might appreciate them.

4. You can help to reduce conflict for those left behind by making your wishes known

When you make a Will, you are officially saying how you would like your financial and personal possessions to be distributed. It could mean that there are fewer arguments between family members as to who should receive what share if you have made your wishes known. If you are estranged from family members and you would not want these people to inherit, then making a Will is the only way you can prevent the intestacy rules being automatically applied.

5. You can reduce or avoid losses to Inheritance Tax

Depending on the value of the assets you own, Inheritance Tax may an issue for your family. The inheritance tax rate is 40%! This could mean a large and unexpected tax bill for those left behind.

This is not just a problem for the very wealthy. You need to consider the value of your home, cash assets and any additional properties you may own.

The good news is that if you plan ahead, there are many legitimate options to reduce or even eliminate loss to this type of tax. Making a Will is part of this planning and can help your family to gain the most from what you have to leave them rather than the Government.

For further information or to book an appointment, contact www.trentwillsestates.co.uk or call 0115 8461446