Pensions and Inheritance Tax – the upcoming changes that you need to know about

Currently, defined contribution pensions, where you build up a pot of money to give you an income when you retire, wouldn’t normally be part of your taxable estate and there would be no inheritance tax to pay. The ‘estate’ simply means all the assets, like a house, investments or valuables, that someone owns when they die.

From 6 April 2027, defined contribution pensions will be subject to inheritance tax. This will impact upon the amount of inheritance tax that is due on your death. The standard rate of inheritance tax is 40%.

This blog will explain the changes, provide an example, and consider practical actions that you may wish to implement. This factsheet will focus on Defined Contribution pensions rather than Defined Benefit pensions. Defined contributions are those where a ‘pot’ is usually built up and is invested.

There are no planned changes to the treatment of income tax on pensions on death and so this factsheet will focus on Inheritance tax, rather than income tax.

The Nil Rate Band and Residence Nil Rate Band

Inheritance tax is a tax paid on the estate of somebody who has died.

In most circumstances, there would be no inheritance tax due if either:

- The value of your estate is below £325,000

- You leave everything above the £325,000 to your spouse / civil partner, or a charity on your death

Your threshold may increase by a further £175,000 (£350,000 married couple) if you have a home and leave this to a qualifying beneficiary (e.g. child or grandchild) upon your death (The Residence Nil Rate Band). This means a married couple can potentially have combined allowances of up to £1,000,000, meaning inheritance tax would only be due if their combined estate was over this amount. The RNRB can be restricted depending on the property value and on estates exceeding £2million. If your total estate is worth more than £2m, the RNRB will taper off by £1 for every £2 above this threshold.

Changes from 6th April 2027

Unused pension capital will be included in the calculation of the estate value for inheritance tax purposes. This means that inheritance tax may be due on your pension capital. It is expected that any liability will be split proportionately between the estate and the pension.

Example

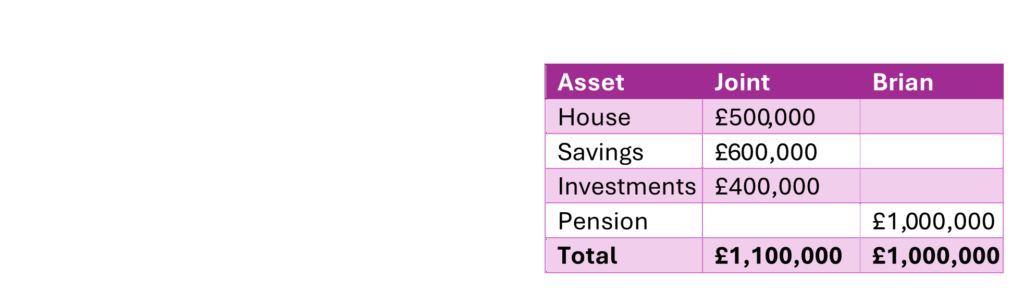

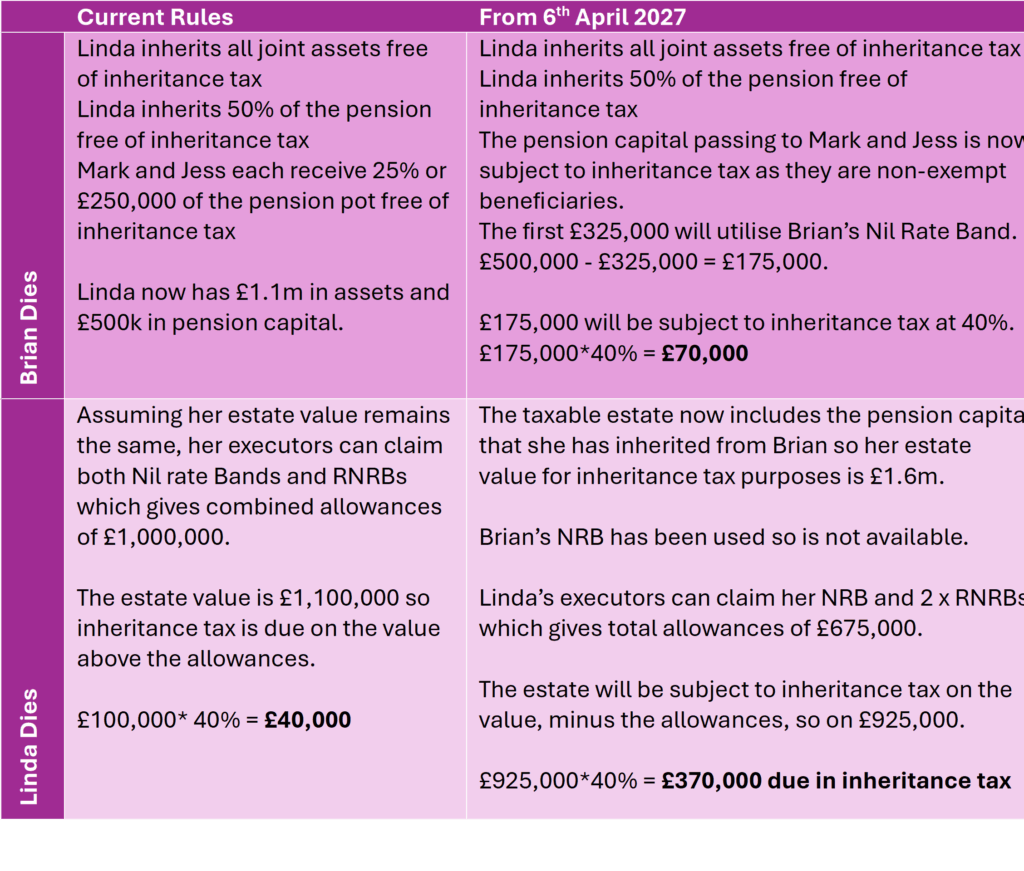

Brian and Linda are a married couple with two children. They have joint assets of £1.1m and Brian has pension capital of £1m. Brian and Linda have mirror wills, leaving all assets to each other on first death and equally to their children on second death. Brian has completed a pension death benefit nomination in the following proportions: Linda 50%; Mark 25%; Jess 25%.

The table above shows the current assets. The table below shows how the assets will be treated under the current rules and then how they will be treated when the new rules are applied from April 2027.

We can see that previously there is a £40,000 liability in place with the current rules, and once the new rules are in place, this will increase by £400,000, meaning the total liability is £440,000. This is due to the £70,000 liability due on Brian’s death and a further £370,000 due on Linda’s death.

In this scenario, if Brian left all of his pension capital to his wife on first death, there would be no immediate inheritance tax liability. On second death, there would be a liability of £460,000. This would be due to tapering of the RNRB as Linda’s estate value would be over £2 million (she would lose £50,000 of the RNRB and so have total allowances of £950,000)

Dealing with IHT

From April 2027, the personal representatives or Executors will be responsible for dealing with the IHT due on pensions. It is expected that they will need to liaise with pension scheme administrators. This will be an additional burden.

Key considerations

- If you have pension plans, ensure records are kept up to date. Keep any statements with your will so that executors can access this information.

- Ensure your expression of wishes or nominations are up to date as they will not be dealt with by your Will.

- Understand that any non-exempt beneficiaries will utilise your Nil Rate Band (for pensions from 6th April 2027).

- You may benefit from seeking financial advice in relation to your specific situation, any potential inheritance tax liability and actions you can take to address any tax liability.

Trent Wills and Estates Inheritance Tax Summary Service

We are now able to offer an inheritance tax assessment report. This will provide you with a summary of your current position, and position post April 2027. It will take into account your assets and liability, any previous gifts made and also the structure of your will. The report is not intended as financial advice and provides a snapshot in time of your current position. The fixed cost for this service is £750 + VAT. Please contact Sally Jackson if you are interested in this service.

Sally@trentwillsestates.co.uk

07921196730